Our track record in the alternative investment, inter alia micro finance, funds of hedge funds, sovereign funds, asset managers, banks and regulators demonstrates Soft-Finance’s capacity to deliver consulting projects on schedule and within budget. Financial institutions, large and small benefit from our senior consultants expertise in the alternative industry gained at all levels of the industry gained over the years.

We provide better research, enabling faster informed decisions.

With a clear vision about data quality and a proven track record of consulting expertise and innovative IT solutions, we’re able to deliver an unparalleled user experience to our clients and even sometimes make some research projects possible.

Fintech use cases

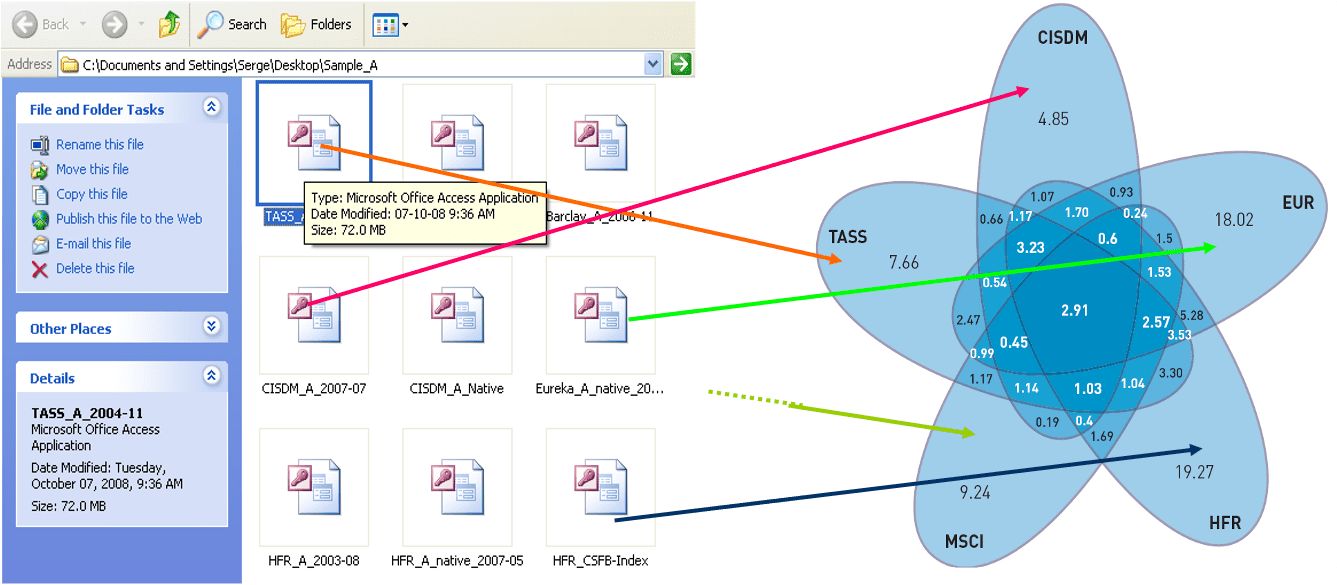

Alternative fund screening

Soft-Finance’s technical experience allows the accurate and meticulous data capture of both qualitative and quantitative elements. The precise and unique characteristics of funds that clients wish to identify can therefore be done across any datasets and universes.

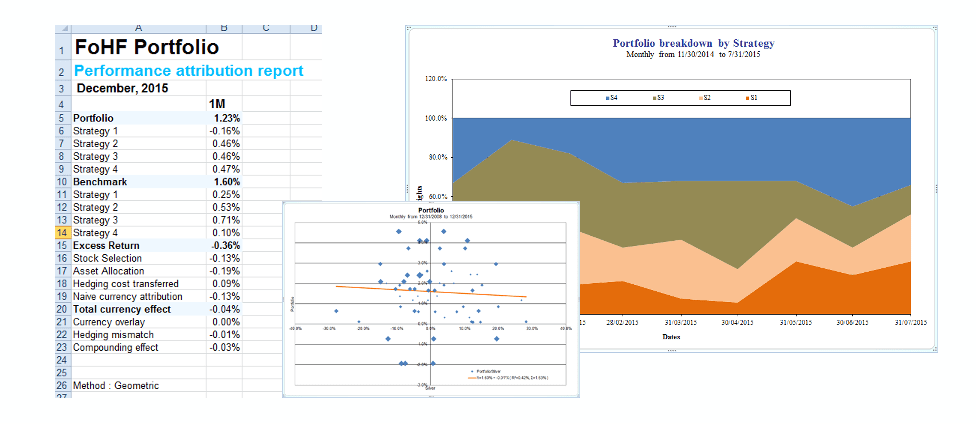

Portfolio analysis

Portfolios can be optimised using the client’s objectives and constraints which may include, other than purely statistical elements (volatility, correlation etc.), counterpart concentration, market exposure among many others.

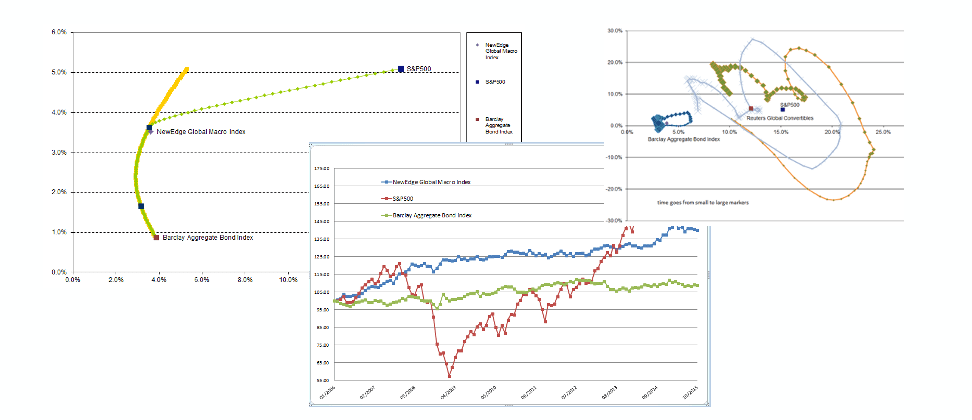

Risk analysis

FDM makes it possible to deeply analyse risks such as: stress testing, multi-factor analysis, contractual liquidity analysis and concentration risk.